What accounts can I access with the mobile app?

The mobile app gives you access to savings, checking, and loan accounts.

The mobile app gives you access to savings, checking, and loan accounts.

How do I set up the mobile app?

Download and install the app from your phone’s app store, then use your Online Banking login credentials. It’s that easy!

Download and install the app from your phone’s app store, then use your Online Banking login credentials. It’s that easy!

Is there a fee associated with using the mobile app?

The mobile app is free to use. However, please note that your mobile carrier’s data and text rates may apply when using your device to access it.

The mobile app is free to use. However, please note that your mobile carrier’s data and text rates may apply when using your device to access it.

My mobile app used to work; now it doesn’t. What happened?

Please make sure you have the latest version of the mobile app from the Google Play or Apple store, or call the Contact Center at 540-389-0244 (local) / 866-389-0244 (toll-free) for assistance.

Please make sure you have the latest version of the mobile app from the Google Play or Apple store, or call the Contact Center at 540-389-0244 (local) / 866-389-0244 (toll-free) for assistance.

Is my login information the same as for Online Banking?

Your Online Banking username and password are also used for the mobile app. If you need assistance with resetting your login credentials, please call the Contact Center at 540-389-0244 (local) / 866-389-0244 (toll-free), or speak to a personal banker at a branch convenient to you.

Your Online Banking username and password are also used for the mobile app. If you need assistance with resetting your login credentials, please call the Contact Center at 540-389-0244 (local) / 866-389-0244 (toll-free), or speak to a personal banker at a branch convenient to you.

Do I have to set up online banking in order to use the mobile app?

Online Banking and Mobile Banking are the same feature on different devices, so you will need to enroll in Online/Mobile banking to use either one. You can do so by calling our Contact Center at 540-389-0244 (local) / 866-389-0244 (toll-free) or by visiting a branch for assistance.

Online Banking and Mobile Banking are the same feature on different devices, so you will need to enroll in Online/Mobile banking to use either one. You can do so by calling our Contact Center at 540-389-0244 (local) / 866-389-0244 (toll-free) or by visiting a branch for assistance.

Opening a New Account

Opening a new account or applying for a loan through your mobile app makes things especially quick and easy. Since you're already logged in to our secure platform, much of your information is already filled out.

Here's how you can get started with just a few quick taps:

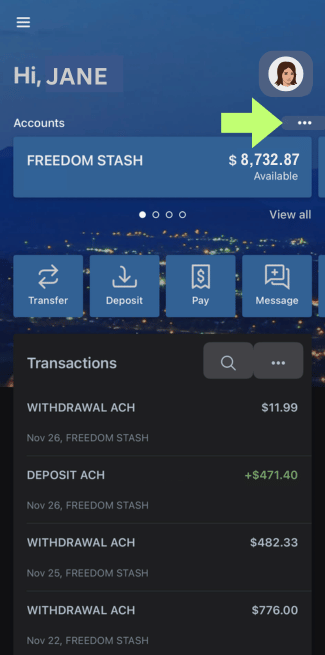

Step 1: Open your mobile app or online banking.

Step 2: Find the 3 dots below your profile picture and click or tap.

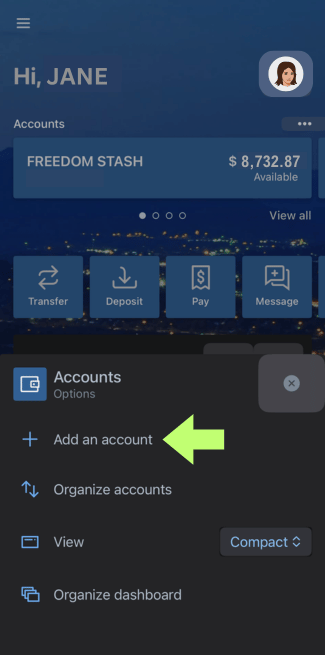

Step 3: Click or tap "Add an account."

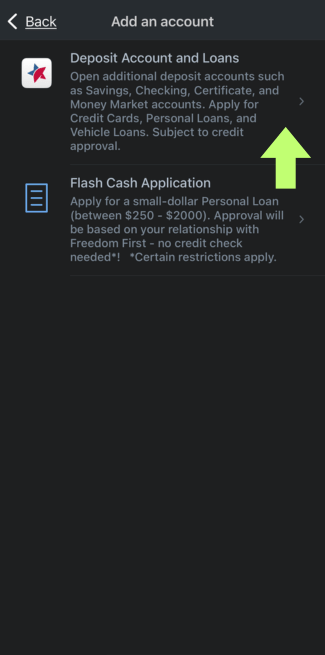

Step 4: Click or tap "Deposit Account and Loans" to access the application.

Deposit Anywhere FAQs

Can I make deposits with my mobile app?

Yes, check deposits can be made with the Deposit Anywhere feature on the mobile app. Check images are not stored on the device. Please make sure your email address and phone number are listed correctly in your Online Banking settings.

Yes, check deposits can be made with the Deposit Anywhere feature on the mobile app. Check images are not stored on the device. Please make sure your email address and phone number are listed correctly in your Online Banking settings.

What types of checks can I deposit using Deposit Anywhere?

You may deposit personal, business, and government issued checks payable in U.S. dollars and drawn at any U.S. credit union or back. You may not deposit international checks, savings bonds, money orders, remotely created checks, convenience (line of credit) checks, nor cash.

You may deposit personal, business, and government issued checks payable in U.S. dollars and drawn at any U.S. credit union or back. You may not deposit international checks, savings bonds, money orders, remotely created checks, convenience (line of credit) checks, nor cash.

When may I deposit checks using Deposit Anywhere?

You may deposit checks 24 hours a day, 7 days a week, 365 days a year.

You may deposit checks 24 hours a day, 7 days a week, 365 days a year.

Do I have to do anything different when endorsing the check for Deposit Anywhere?

Endorse the check as normal, and then add For e-Deposit Only.

Endorse the check as normal, and then add For e-Deposit Only.

How long does it take for a deposited check to clear when I use Deposit Anywhere?

In most cases, funds will be available in less than 15 minutes. Holds depend on the type and amount of the check, as well as the status of the account. You will receive a text message if business rules enable the funds to be released prior to standard hold times as described in your Account Agreement.

In most cases, funds will be available in less than 15 minutes. Holds depend on the type and amount of the check, as well as the status of the account. You will receive a text message if business rules enable the funds to be released prior to standard hold times as described in your Account Agreement.

What should I do with my checks after using Deposit Anywhere?

Please be sure to retain each original check that you deposit using this service for 60 business days after funds have been posted to your account, at which time you should then dispose of the check in a secure way to prevent the check being presented for payment again. When you receive the funds in your account, you should mark the check “VOID.” Please be sure to store each retained check in a secured locked container until 60 days has passed and proper disposal is completed.

Is there a fee for using Deposit Anywhere?

Deposit Anywhere is free to use, but your mobile carrier may charge for text or data usage.

Deposit Anywhere is free to use, but your mobile carrier may charge for text or data usage.