What You'll Need

- Government issued ID (driver’s license, state or military ID, passport with current address) for all signers on the membership

- Physical & mailing address

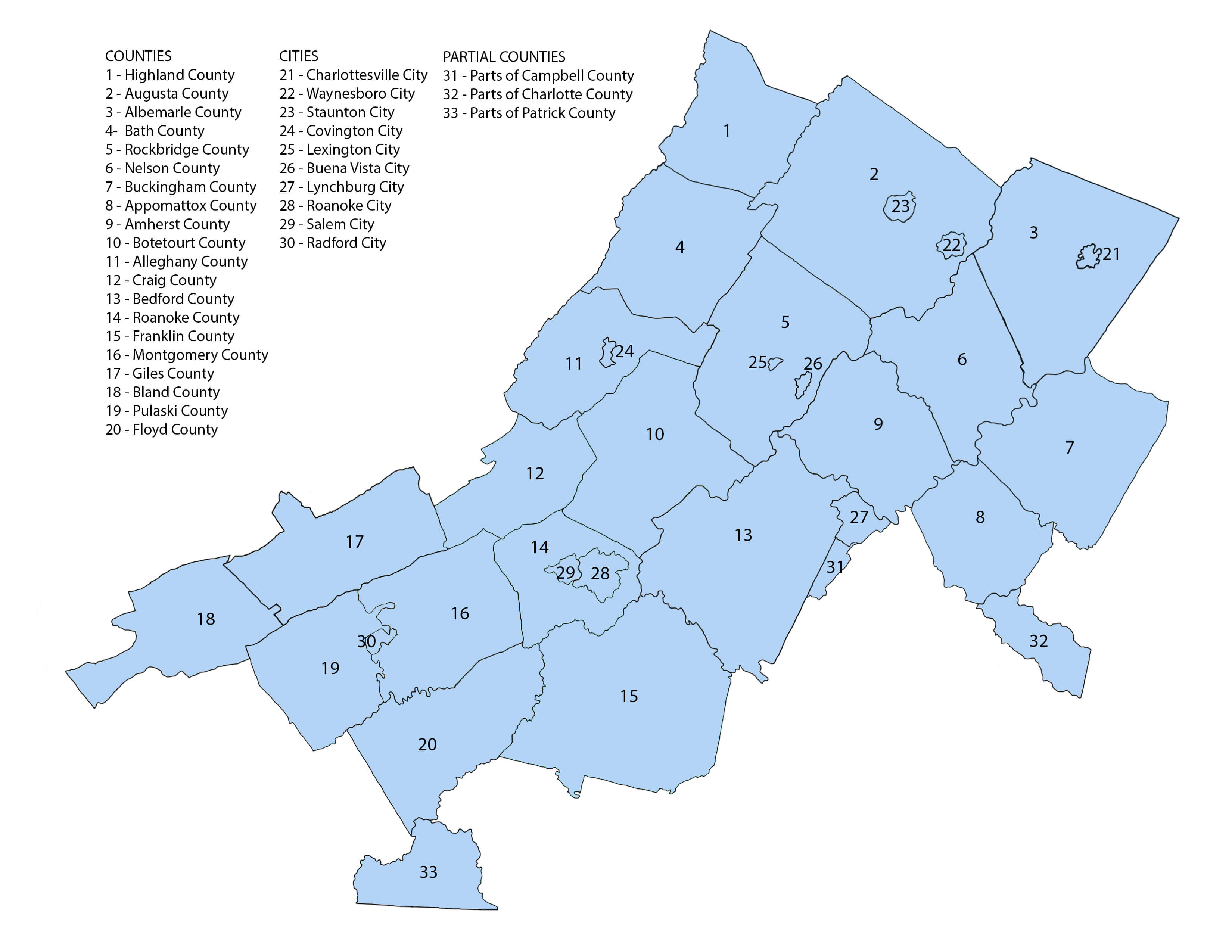

- Check eligibility requirements

Below is a list of other required documents needed based on the entity type of your business. Additional documentation may also be required.

- Sole Proprietorship: Fictitious name certificate and/or business license in the city/county in which the business operates, if applicable

- Estate: Death Certificate, copy of court-appointed Certificate/Letter of Qualification

- Trust: Death Certificate, copy of Qualification Letter (for Testamentary Trusts only)

- Nonprofit Organization: In addition to any documentation needed based on entity type as listed above, a Letter of Verification from the IRS is required for Nonprofit Checking accounts.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth and other information that will allow us to identify you. We may also ask to see your driver's license or other identifying documents.