Financial Empowerment Center

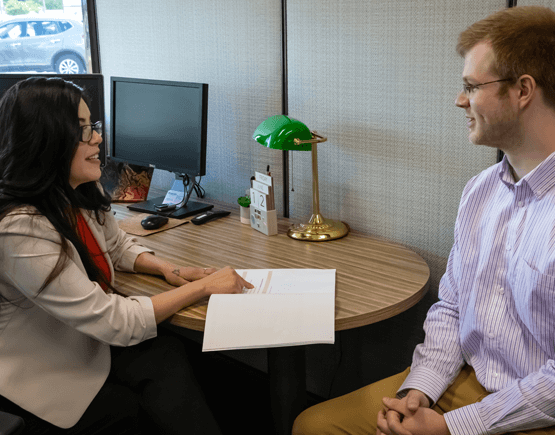

The Financial Empowerment Center offers professional, one-on-one financial counseling at no-cost to people who live and work in Southwest and Central Virginia. Our certified financial counselors can assist you in English or Spanish with:

- Money management

- Budgeting

- Reducing debt

- Establishing and improving credit

- Connecting to safe and affordable banking services

- Building savings

- Referrals to other services and organizations

- And more

When you attend a free one-on-one coaching session, you'll receive:

1. A non-judgmental experience tailored to your needs

2. A soft inquiry of your credit report and score (which means it will NOT impact your score)

3. A personalized action plan based on your goals

We are proud to partner with the City of Roanoke and Cities for Financial Empowerment Fund to bring this important service not only to Freedom First members but to our greater community.

Schedule a no-cost, one-on-one session with one of our certified Financial Counselors:

Online: e3endeavors.org/fec

Email: education@freedomfirst.com

Phone: (540) 378-8928

GreenPath Financial Wellness

- Monday - Thursday: 8 AM - 10 PM (EST)

- Friday: 8 AM - 8 PM (EST)

- Saturday: 9 AM - 6 PM (EST)

Classroom-Style Financial Education

Self-Study

- The LearningLab

- Real $tories Podcast

- Worksheets and Guides

- Webinars

- Credit Card Debt Management Tools

- GreenPath Blog

Speak to an expert.

The Financial Empowerment Center is available to anyone in our region at no cost to them, even if you're not a member of Freedom First.

The professionally-trained counselors work with you in a judgment-free environment to achieve your financial goals.

Manage your budget from your phone

Our Money Manager tool lets you manage your budget, set goals and alerts, and view the full financial picture - all right from your Online/Mobile Banking!